Controlling real estate fees can often feel overwhelming, with complex calculations, shifting rules, and the constant stress to reduce liabilities. But in the current electronic age , real estate tax pc software is emerging as a robust software to simply help house homeowners, investors, and businesses improve best tax software for rental property while saving money.

Why Real Estate Tax Software is a Game-Changer

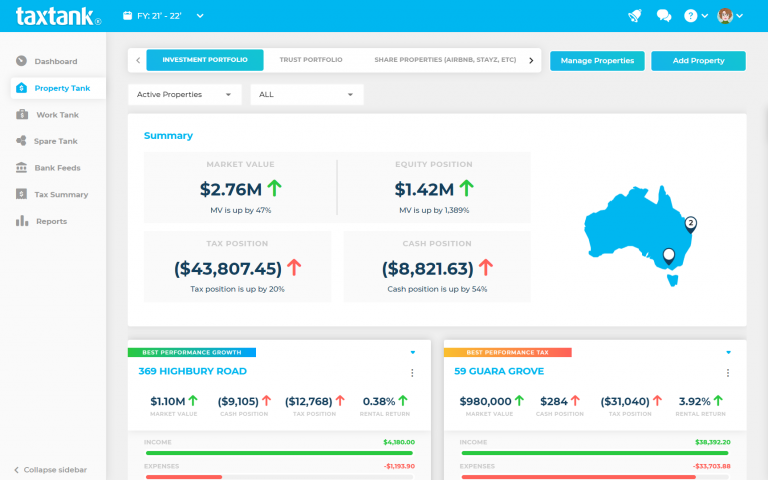

New statistics spotlight the significant economic advantages of leveraging sophisticated engineering for duty management. In accordance with surveys, businesses that adopt automatic tax alternatives report up to 20% lowering of planning and processing errors. These errors not just charge time but frequently lead to penalties that may have been avoided. By reducing information operations and individual errors, real estate tax pc software assures higher precision and compliance.

Furthermore, property homeowners can enhance deductions and learn overlooked possibilities for savings. Many tools now use sophisticated algorithms to immediately identify and label deductible expenses, such as for example depreciation, preservation fees, and interest payments. With tax auditors mentioning imperfect or wrong deductions among the prime reasons for audits, the ability to enhance precision becomes invaluable.

Key Benefits of Using Real Estate Tax Software

One of the most impressive top features of modern tax software is its power to incorporate with existing systems. Whether handling multiple homes or perhaps a simple hire unit, people can simply track revenue, expenses, and tax liabilities in real-time. Computerized revealing features more allow people by giving clear ideas into their tax situation, letting proactive preparing in front of tax season.

Yet another critical gain is keeping up-to-date with shifting tax regulations. Regulations surrounding real-estate taxes are continually changing, and missing key updates can lead to expensive conformity issues. Tax pc software vendors often update their programs automatically to reveal the latest rules and tax rules, ensuring that people remain educated and compliant.

Simultaneously, when it comes to audits, having structured and readily available certification is crucial. Real-estate tax software assists keep centralized records, removing the disorderly last-minute scramble for bills or documentation.

Take Control of Your Tax Strategy

Property tax pc software provides more than ease; it offers users an important side in optimizing savings, raising compliance, and simplifying the frustrating task of tax management. By adopting that cutting-edge engineering, home owners and companies can concentrate on development while causing the burden of calculations and conformity to a dependable, automatic system.